Property Tax:

559-636-5250

221 South Mooney Blvd.

Room 101 E

Visalia, CA 93291

Tax Accounting: 559-636-5280

Email: [email protected]

Fraud Hotline

Tax Accounting: 559-636-5280

Email: [email protected]

Fraud Hotline

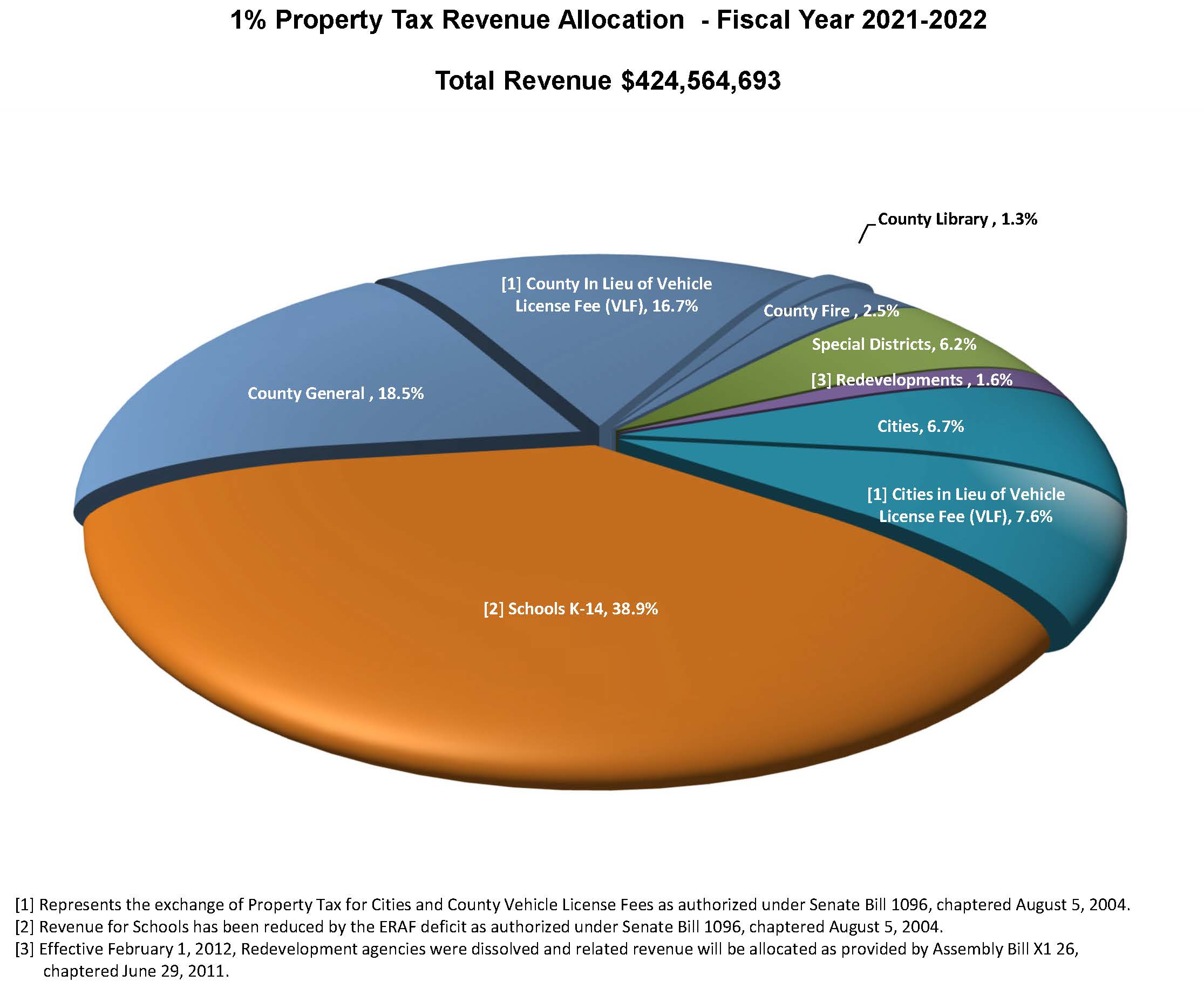

Your property tax bill is comprised of taxes and special assessments and is a lien on your property. Taxes consist of a 1% general levy plus voter approved debt plus any applicable special assessments. Taxes and assessments are specifically identified on your tax bill and are distributed as stated on your bill, with the exception of the 1% general levy (which was established with Proposition 13). The general levy of 1% is distributed among many agencies in the County on a countywide basis:

In 1979, Assembly Bill 8 (AB 8) was adopted to provide procedures for counties to allocate property taxes. The basic premise of AB 8 allocates to each taxing jurisdiction the amount it received in the prior year, plus the change that has occurred in the current year within its boundaries. The revenue allocation of the countywide 1% property tax levy is calculated pursuant to Revenue and Taxation Code section 96.5.

Under the AB 8 method, the 1979/80 base amount for each local agency within a county was calculated based on the property tax allocated pursuant to Government Code section 26912 for 1978/79 and adjusted for the 1979/80 assessed value growth. The property tax allocation percentage for each agency within a Tax Rate Area (TRA) was then established. These percentages are to be recomputed only when certain activities occur such as TRA consolidation, creation of the unitary roll pursuant to Revenue and Taxation Code section 100, and boundary changes affecting specific TRAs, such as annexations, detachments, dissolution of districts, formation of new districts, city incorporations.